Lithium Carbonate: Lithium in Xiongtu

Aug,16,24

Since the end of July, lithium carbonate has broken through the previous low support level and,

combined with weak macro sentiment, has been smoothly declining, accelerating its decline this week.

On August 15th, the main contract LC2411 hit a new low of 71800, followed by market sentiment recovery, closing at 72400, a decrease of 3.21%.

The resonance of futures and spot prices has accelerated the decline,

with the SMM battery grade lithium carbonate index falling 2092 yuan/ton in a single day on the 15th, reported at 75255 yuan/ton.

Lithium carbonate has once again experienced a continuous decline, and for six consecutive days,

it has hit a new low in daily increase in positions below the cost line of some high cost projects, with a significant increase in trading volume.

At the same time, there is a marginal improvement in the fundamentals of lithium carbonate, with a slight decrease in production,

a slight increase in demand, and a diminishing marginal accumulation.

Since the end of July, lithium carbonate has broken through the previous low support level

and has been smoothly declining, accelerating its decline this week.

On August 15th, the main contract LC2411 hit a new low of 71800, followed by market sentiment recovery, closing at 72400, a decrease of 3.21%.

The resonance between futures and spot prices has accelerated their decline.

The price of SMM battery grade lithium carbonate index is 75255 yuan/ton, a decrease of 2092 yuan/ton compared to the previous working day;

Battery grade lithium carbonate costs 72300-78400 yuan/ton, with an average price of 75350 yuan/ton,

a decrease of 2100 yuan/ton compared to the previous working day;

Industrial grade lithium carbonate costs 7000-70800 yuan/ton, with an average price of 70400 yuan/ton,

a decrease of 2100 yuan/ton compared to the previous working day.

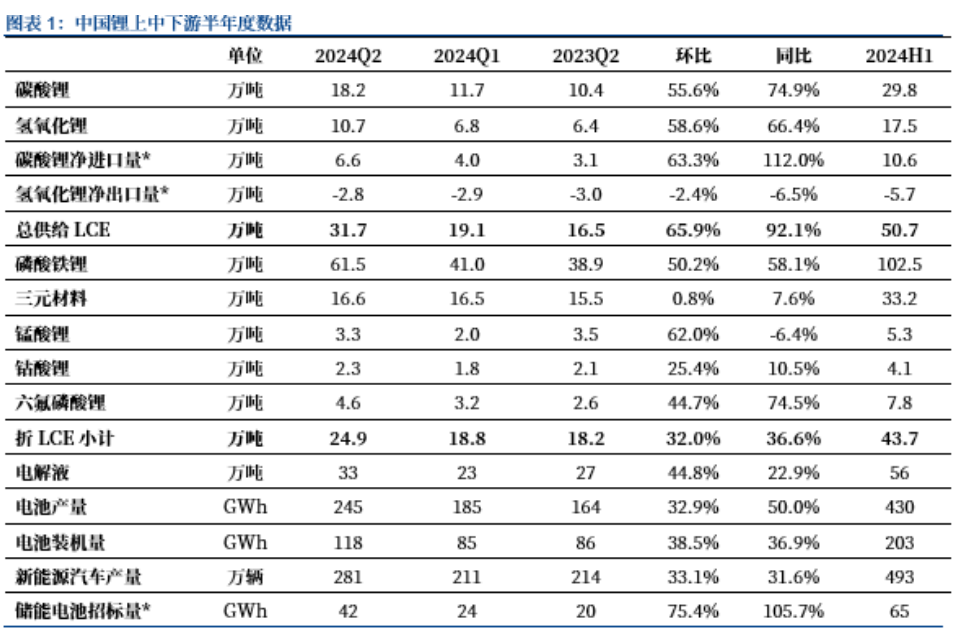

1、Domestic lithium salt production growth rate far exceeds expectations

In July 2024, the production and sales volume of lithium batteries in the upstream, midstream, and downstream markets were released,

and the supply growth rate was higher than the demand on a month on month basis.

When sorting out the data for the first quarter, the supply growth rate is still lower than the demand growth rate,

and both spot and futures prices of lithium carbonate have rebounded.

Since the second quarter, lithium salt production has continued to exceed the expected value at the beginning of the month.

Looking back, the cumulative difference between the actual value and the expected value of lithium carbonate from April to June was 14000 tons,

accounting for 7-8% of the total quarterly production;

Although the production of lithium carbonate in July has declined from its peak, its supply growth rate is still as high as 45.3% year-on-year,

while the demand growth rate is only 15.3% year-on-year.

The actual monthly production in the second quarter has increased compared to the expected value,

indicating that domestic lithium carbonate production capacity and lithium ore raw materials are abundant,

and there is a premium in futures prices for most of the time.

The raw materials purchased by lithium salt factories can be immediately hedged on the market,

and domestic lithium ore can be quickly converted into lithium carbonate products.

There is no need to worry about the adverse effects of lithium price drops on oneself.

The higher the capacity utilization rate, the lower the cost amortization, and profits can be generated.

Comparing the year-on-year supply and demand in the second quarter,

it can be clearly seen that the growth rate of demand is better than expected,

but the 92% year-on-year growth rate on the supply side is indeed completely beyond the demand.

So there was another mismatch between supply and demand,

from supply being slower than demand in 2021 and 2022 to supply far exceeding demand, entering a new round of supply-demand mismatch.

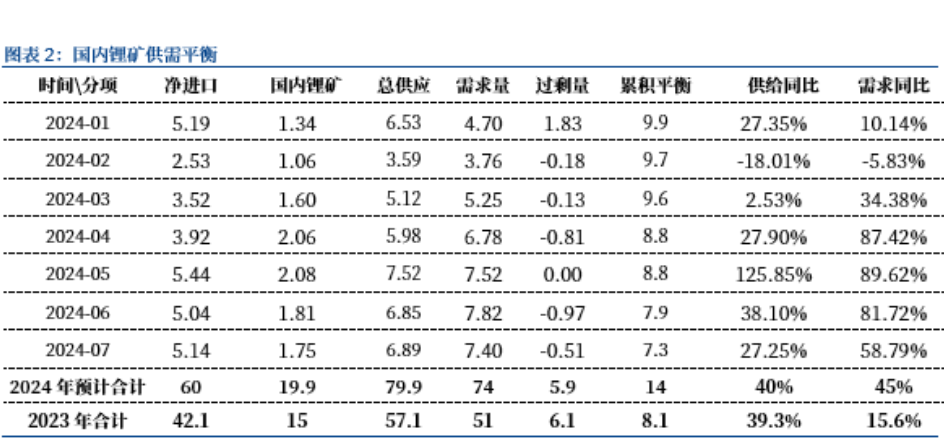

2、Domestic lithium mines achieve destocking from January to July

The unexpected supply of lithium carbonate in China consumed last year's accumulated lithium mine reserves.

The lithium ore that did not have a chance to be converted into lithium carbonate in 2023 had a negative basis by the end of 2023,

providing a good hedging opportunity.

In March and April 2024, due to short-term supply-demand mismatch caused by major factory maintenance,

lithium carbonate surged to the level of 120000 yuan/ton, exceeding industry expectations.

This also provides a good hedging position for the excess lithium mines.

Coupled with the unexpected demand side, companies that have tried hedging and have profits are more flexible in using futures tools.

The market position has steadily increased, with the total contract position exceeding 300000 lots,

and the subsequent position has remained stable at 230000-330000 lots.

From January to July 2024, China's net import of lithium ore was 308000 tons of LCE, with domestic ore accounting for 117000 tons of LCE.

The demand for lithium ore was 432300 tons of LCE, and 7500 tons of LCE were destocked.

However, in the second half of the year, as lithium ore prices continue to decline and absolute prices gradually approach the cost line,

domestic lithium ore may return to a state of accumulated inventory.

The supply-demand balance of lithium mines in China in 2023 is a cumulative inventory of 61000 tons of LCE,

and 2023 is also a year of rapid price changes.

High priced lithium mine inventory is also the reason why many lithium listed companies are losing money.

3、The proportion of long-term cooperation is higher than the same period last year

Both lithium carbonate and lithium hydroxide have a much higher proportion of long-term partnerships among the top ten

lithium salt factories worldwide (including overseas) compared to the same period last year.

ALB has mentioned in its recent two quarterly reports that approximately two-thirds of lithium sales are under long-term agreements,

with pricing based on the lithium salt index; The remaining one-third is based on flexible market prices.

ALB has tried the auction system this year, with the specific process of auctioning lithium carbonate twice a month,

with each auction weighing around 100 tons.

This quantity is very small in its overall sales volume and is not the main sales method,

but it can more efficiently understand the expected price of buyers in the market.

Domestic leading lithium salt factories such as Tianqi, Shengxin, CITIC Guoan, etc.

have also increased the proportion of long-term contracts for lithium salt sales this year,

and these companies have shown significant growth this year;

The Fengxin Era, Wanzai Era, and Yifeng Era, which Yichun Era has invested in, have seen a rapid increase in production after the second quarter.

It is understood that the lithium carbonate produced by these three companies is used as customer supply for Ningde Era,

so most of this year's increment will flow to Changhe Union's customer supply.

This also leads to the inability to release speculative demand during peak season expectations when the overall trading atmosphere is poor,

resulting in a lack of market vitality and a high proportion of long-term contracts continuing to suppress lithium prices.

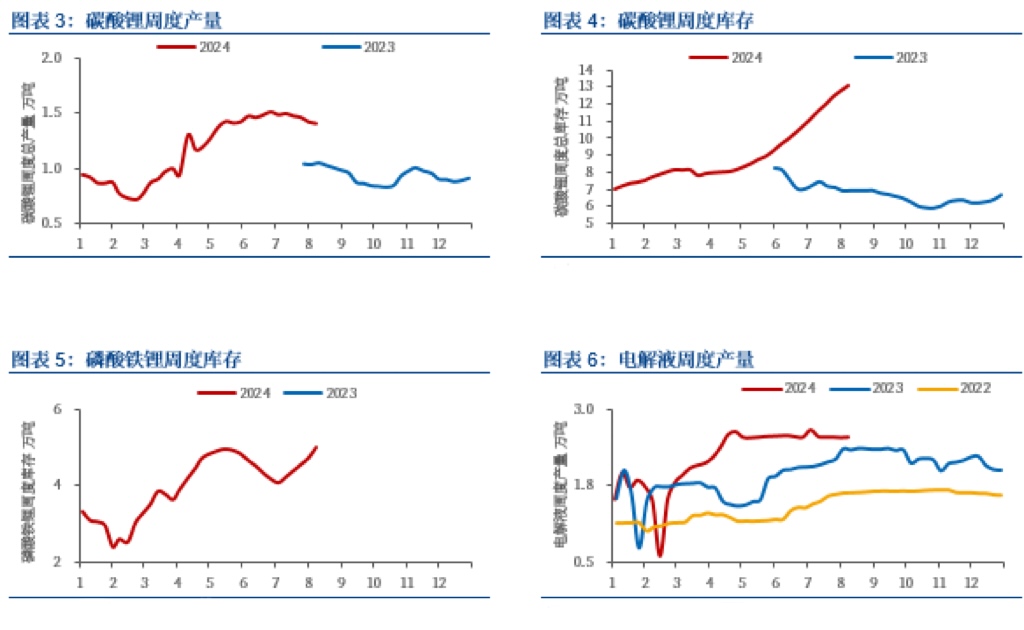

4、Weak marginal improvement in fundamentals

In July, there was a marginal improvement in the fundamentals of lithium carbonate, but the overall magnitude was weak;

This improvement is expected to continue to deepen in August, as production continues to decrease,

demand continues to increase, and the cumulative inventory margin decreases.

But the market did not price according to this, and the marginal improvement did not bring emotional recovery.

After analysis, it is still due to the reasons mentioned earlier.

Firstly, there is accumulated inventory, and secondly, long-term contracts have weak demand growth compared to the previous period.

This incremental growth can be solved by existing long-term contracts or customer supply,

so there is no market demand that will increase after the marginal improvement,

so naturally the inquiry and transaction volume are relatively poor.

If the price drops directly below the cost line of Australian mines, we will wait and see if the horn of clearing production capacity can be sounded.